If you want to run a successful subscription coaching program, you need to know where you stand with these 4 essential subscription business model metrics.

by

Mac Gambill

August 10, 2020

People love subscription business mobels because once you have them off the ground they can drive predictable revenue and cash flow, and we’ve found recurring models work really well for coaching businesses.

It ensures you are attracting the right type of client with the right expectations. Outcomes don’t happen overnight so it’s important to bring in clients who are bought-in and understand that it will require months of hard work to see results.

In past posts we’ve touched on variables used to dictate models and pricing, such as the amount of 1-to-1 interaction, and how accompanying content is delivered.

We even outlined a few benchmark figures for a coaching subscription model:

Generally offer 1-2 sessions per month (45-60 min each)

Generally charge anywhere between $50-200/session depending on experience

Some offer packages that cost well over $1,000

We typically see coaches leveraging some variation of a 3-month program as their standard offering, then they may have a high ticket offering or lower cost maintenance plans that they subsequently promote to clients.

In either case, that means needing to be familiar with the basics of managing a subscription business, including some of the fundamental metrics that power these businesses:

Key Metrics for Subscription Business

Client-count aside there are a few other subscription business model metrics you are going to want to keep your eyes on as they will give you a better sense of how much you can be spending on marketing and whether you have a sustainable business:

Monthly Recurring Revenue (MRR)

Monthly Churn

Customer Acquisition Costs (CAC)

Customer Lifetime Value (CLV)

Luckily, there are systems on the market that sit on top of payment processors, like Stripe, making it easy to track these metrics based on your actual data.

Baremetrics - a platform that touts being the hub for metrics, dunning, and engagement tools for subscription business models - has an academy that’s a handy reference for deep dives on more business metrics, but for now focus in on our four essentials.

In fact, we use Baremetrics internally to track of many of our key subscription business model metrics because it sits on top of the Stripe account we use to collect payments, so I’ll use their graphs as examples below.

1. Monthly Recurring Revenue (MRR)

MRR is all of your recurring revenue normalized into a monthly amount. It’s a way to average your various pricing plans and billing periods into a single, consistent number that you can track the trend of over time.

For subscription-based business models, this number often plays a central role in how the overall value of the business is estimated.

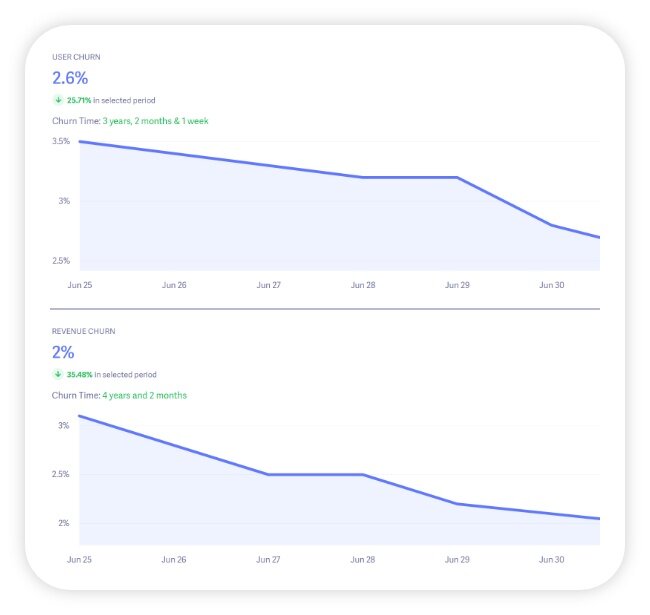

2. Monthly Churn (account vs revenue)

Churn is the amount of business lost in a given month and can either be calculated in terms of number of customers or revenue. Both are illustrated as a percentage.

3. Customer Acquisition Costs (CAC)

Money that’s spent on convincing a customer to make a purchase is called the Customer Acquisition Cost.

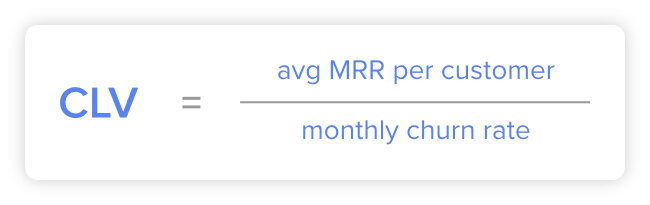

4. Customer Lifetime Value (CLV)

In a subscription business model, this is the predicted amount a customer will spend on your product or service throughout the entire relationship, hence – “lifetime.” You ultimately want this number to be 3x greater than your CAC.

Luckily, we can calculate CLV using a couple of the key performance metrics we’ve already discussed above, taking the average monthly recurring revenue per customer and dividing by your monthly account churn.

Let’s Try An Example

Using the information above let’s assume you are running a coaching subscription model business with two simple offerings and the following details:

You offer a simple 3-month coaching package that runs for $900 (i.e. $300/month)

Once complete, your clients can continue with you at $300/month

With a simple $1,000 campaign on Facebook you’ve been able to acquire your first 10 clients for your program

Unfortunately, 1 of your clients decided not to renew this month

Now, based on those variables let’s quickly calculate some of the subscription business model metrics above.

MRR

10 clients x $300 per month = $3,000

Account Churn

1 client lost / 10 total clients = 10% monthly churn

CAC

$1,000 FB spend / 10 clients acquired = $100 to acquire a customer

CLV

$300 / 10% churn rate = $3,000

Now that we’ve calculated the numbers, we can take a step back and quickly make some observations about this subscription business model:

This is a viable subscription business model - for every dollar being invested in sales and marketing, we are seeing a return.

That said, if you are regularly losing 10% of your customers each month that means that over the course of the year you will lose and need to replace about 75% of your customers! This means you will need to consistently be focusing on customer acquisition in parallel with managing your current clients.

Luckily with a $3,000 CLV, you can spend up to about $1,000 acquiring a client (remember, you want CLV to be 3x greater than your CAC) meaning you should be able to increase your marketing spend to drive consistent leads for your business.

Let’s assume you wanted to make at least $75,000/year ($6,250/month) you would need to maintain approximately 20 clients all year round to achieve your goal. Is that reasonable?

Remember, you can either build a subscription business model around having few clients paying you large sums of revenue or a large number of clients paying you smaller amounts. Work backwards from your revenue goal to make sure you don’t create a subscription business model that becomes unsustainable for you in the long term.

For instance, if you wanted to create a $50/month offering but still had the same aspirations of earning $75,000/year then you’d need to consistently manage 125 clients each month. That may work in a scalable maintenance plan, but it would be difficult to tackle if that was the rate for standard coaching services that included detailed program creation and multiple telephonic or video interactions each month.

Summing Up

How much can I afford to spend on promotion right now?

Is my advertising bringing in enough clients for the amount I’m spending?

Do I have enough clients to hit my personal annual salary goal?

Do I need to keep clients longer or add an upsell offer to continue growing my business?

All these questions and many, many more can be answered with a sound understanding of the essential subscription business model metrics in this post.

Understand them, track them religiously, and you will consistently make better decisions throughout the lifetime of your business.

Are you already tracking these metrics in your business? Using others to make decisions? Have other questions about subscription business model metrics? Share your thoughts in the comments below.