This is our complete guide to the best methods to collect payments for your coaching business. Find out which solutions fit your business based on your needs.

by

Mac Gambill

Co-Founder & CEO at Nudge

How am I going to collect payments from my coaching clients?

Like most coaches, you’ve probably asked yourself this question in hopes that you could find a solution that was easy to set up, was reasonably priced, and made it simple for your clients to pay for your coaching services.

Some are better suited for coaching businesses performing in-person interactions with clients, while others may be better suited for more established coaching businesses or those with remote clients.

This day in age there are no shortage of products on the market, but where do you start?

It’s for this reason that we’ve outlined some of the best methods of collecting payments for your business depending on whether you want to consider simple consumer platforms, or need a full business solution.

Consumer and Small Business Platforms

Venmo

Venmo started as a simple-to-use social payments platform solving the pain-point of sending money to friends, and as such it’s easy to see why the platform may be an attractive starting point for coaches looking to collect their first dollars.

Depending on preference a user can either select to connect their bank account or credit/debit card, which will have an impact on any potential fees incurred throughout the experience.

To receive funds, your client would need to follow the process below

download/open the Venmo app

Search/select you as a recipient

Input the amount they would like to send you

Unbeknown to most, the platform also has a business offering allowing companies to accept Venmo payments through an embeddable widget on their website as an additional payment option for clients.

Pricing Overview

Depends on whether you connect to your bank account or debit card vs. a credit card.

Sending Money

Bank account or Debit Card → $0 to send money

Credit Card → 3% of sent amount

Receiving Money

Venmo gives you two distinct options to access the funds in your Venmo account.

STANDARD (Electronic Withdraw)

Deposited into your bank account within 1-3 days.

$0

INSTANT TRANSFER (Electronic Withdraw)

Deposited into your bank account within minutes.

1% (minimum $0.25 fee, maximum $10 fee)

Zelle

Zelle was introduced in 2017 by some of the largest banks in the industry as a competitor to Venmo. The system works similarly, but in addition to having a standalone app, the platform is already integrated within most banking systems.

Zelle can either be accessed through your client’s bank account or through the Zelle app. To receive money your client simply needs to input your email or phone number and select the amount to send.

If you are already enrolled in Zelle then you should see that money in your bank account within minutes.

Pricing Overview

Unlike Venmo, Zelle is free to use as it’s a simple bank-to-bank transfer.

Coaching Business Platforms

Satori

Satori is an all-in-one client management system that streamlines the entire coaching and business management process for coaches wanting a full solution out-of-the-box to run their business.

From the platform you are able to structure client payments in one of the following ways:

Automatic Invoicing

Send one-time or scheduled invoices to clients allowing them to pay electronically either by credit card or Paypal.Automatic Recurring Payments

Traditional subscription offering allows you to collect payment details once and charge your client based on a predetermined frequency.Offline Payments

All other forms of payment can be manually logged within the system as well.

Pricing Overview

Satori’s pricing is a bit unique relative to other systems as it’s a combination of CRM and coaching system.

Their initial tier starts at $39/month which includes the following; however, they also have a 30-day trial available:

10 active offers

20 active agreements

60 monthly sessions

2,500 contacts

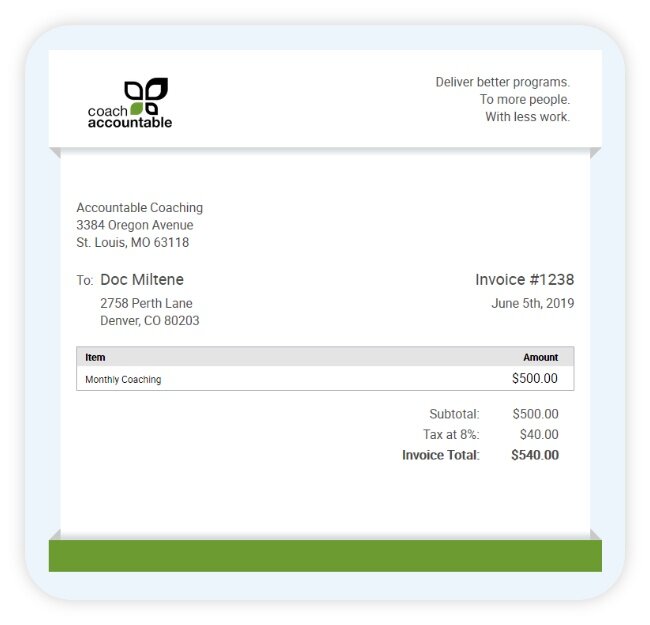

CoachAccountable

Similar to Satori, CoachAccountable covers some of the basic administrative tools of running a coaching business, including one of the main items - accepting payments.

In general, the platform allows you to collect money from clients in two distinct ways:

Invoicing

Ability to send either one-time or recurring email invoices to clients.Offerings

CoachAccountable also allows you to uniquely create and market packages which can be used for clients to self enroll into programs directly from your site. Even better, you can also configure the Offering to automatically trigger an invoice which your client will receive following signup.

Pricing Overview

Like most coaching and personal training systems CoachAccountable’s pricing model is based on number of clients, although they have a more granular pricing model that ranges from $10 to $4 per client per month as your business grows.

Their initial tier starts at $20/month which includes all base functionality, but they also have a 30-day free trial as well.

Business Management Software

Paypal

Being one of the pioneers in payments they have been able to iterate and enhance their offering to include some of the functionality found with some of these newer, innovative systems.

Most people are familiar with the original process of creating and sending money through PayPal accounts, but may not be as familiar with Paypal’s business solutions. Over the past few years they’ve introduced a multitude of services allowing you to:

Collect in-person payments

Collect credit card payments online

Send electronic invoices

Setup subscription payments

Accept payments by phone (use of virtual terminal)

Pricing Overview

Online payments → 2.9% + $0.30 per transaction

Paypal Pro → $30/month

customized checkout experience + virtual terminal

Recurring billing → $10/month

Square

Square was one of the first mobile players in the space, emerging onto the scene with their identifiable, little, white card reader that when plugged into your smartphone turns into a device capable of accepting credit cards.

While it still remains one of the easiest ways to collect a credit card from clients while face-to-face, they’ve since expanded to provide a more well rounded business solution including some really strong features for coaches starting to send electronic invoices to clients:

Send elegant, mobile-friendly, digital invoices to clients

Built in dunning option which sends automated emails to clients reminding them to pay the invoice until said invoice gets paid.

Setup recurring invoices for multi-month coaching packages/offering (clients can select to keep their card on file)

Progress updates on invoices so you can see whether the invoice has been opened, paid, etc.

Track collection trends overtime

Pricing Overview

Base platform → 2.9% + $0.30 per transaction

If your client opts to keep their card on file for recurring payments then you pay 3.5% + $0.15 per transaction

Quickbooks (Online)

Quickbooks is one of the leading accounting systems on the market and is commonly used in most small and medium sized businesses who need a method of collecting payments, track income and expenses, and monitor the health of your business.

The platform allows you to collect payments from clients through their powerful invoicing tool which comes equipped with:

Ability to fully customize invoices to match your brand

Ability for client to pay invoice either by debit/credit card or by ACH transfer

Setup recurring invoices for clients on multi-month plans

Track invoice activity so you can monitor when clients open/pay invoices

Matches invoice payments with invoices in order to keep your books up to date

Pricing Overview

Quickbooks Online has multiple tiers depending on the size and needs of your business, but their SIMPLE START plan starts at $25/month.

Their payment processing fees range depending on whether a client is paying an invoice by credit card or ACH.

Credit Card → 2.9% + $0.25

ACH → 1% of payment amount ($10 max)

Like this article? Learn along with us.

Ultimately, while all of these solutions solve the main pain point of allowing you to collect payments for your coaching business, it’s critical to identify which one best matches the needs of the business and delivers the appropriate client experience.

I asked a few of our coaches about the platforms they used and included a couple of their responses below.

“As far as payment method goes, I use Square for my clients. I have been a licensed cosmetologist for almost 20 years now, so I have two different streams of clientele. I love Square and their method of payment is a percentage for every transaction made with no card use restrictions, so I can take any credit card there is.”

“I have had a lot of success with PayPal, Venmo and Square. If the client is in person I use Square. If they are satellite [clients], I use PayPal or Venmo.”

Any other recommendations? We’d love to hear about your experience with these or any other platforms for coaches.

![Collecting Coaching Payments Online [2020 Guide]](https://images.squarespace-cdn.com/content/v1/54f51011e4b0bd373cdec9da/1534469830475-IWFDIIHUUPXO5GWNZTIG/credit-card-small-blog-feature.jpg)